Star Health IPO comprises fresh issue of equity shares worth ₹2,000 crore and OFS of up to 58,324,225 equity shares by promoters and existing shareholders

Apply IPO On Upstox 👉 Create Account For Free

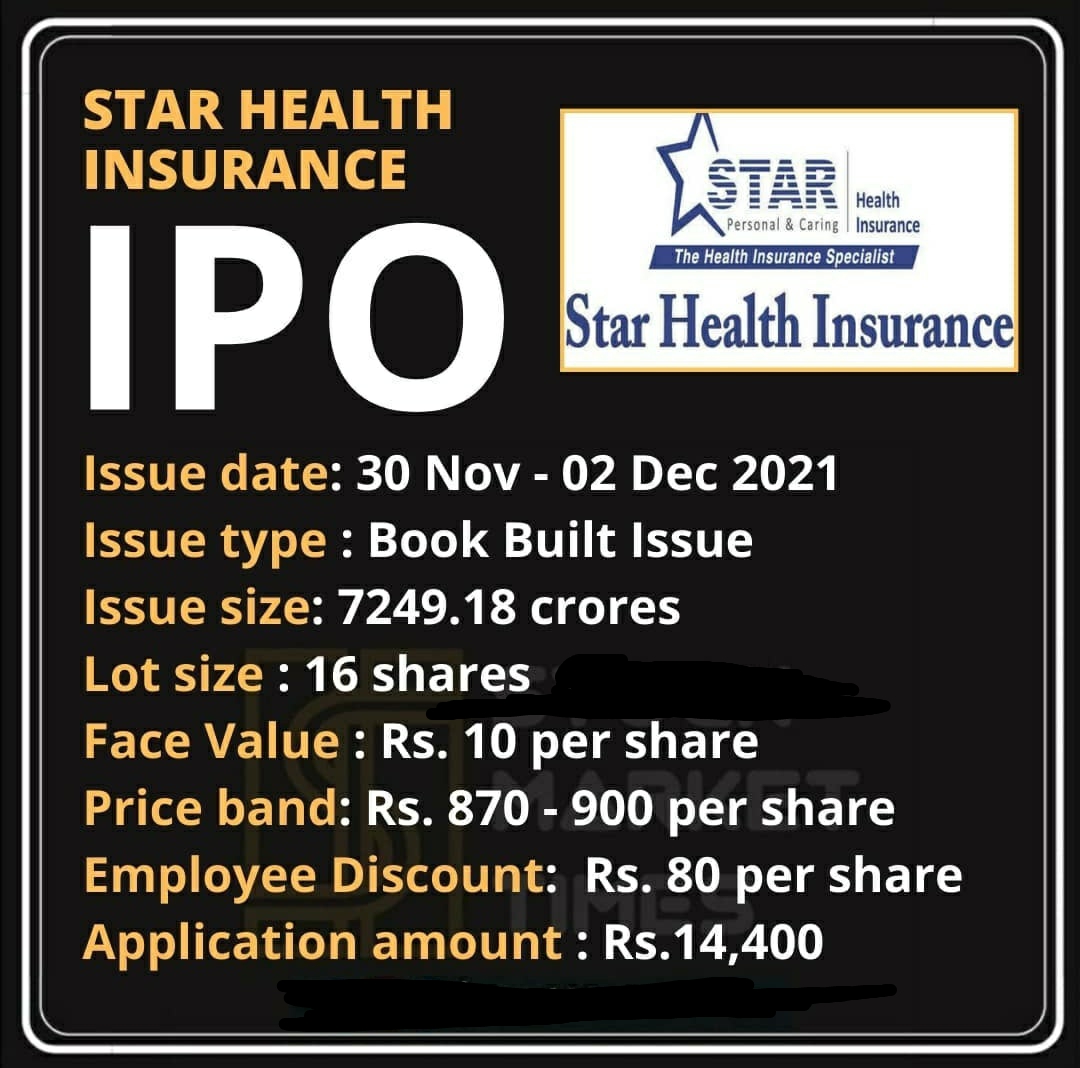

The initial share-sale of Star Health and Allied Insurance Company will open for subscription today and conclude on December 2. The price band has been set at ₹870-900 per share for its initial public offering (IPO). Star Health on Monday said it has raised a little over ₹3,217 crore from anchor investors ahead of its IPO.

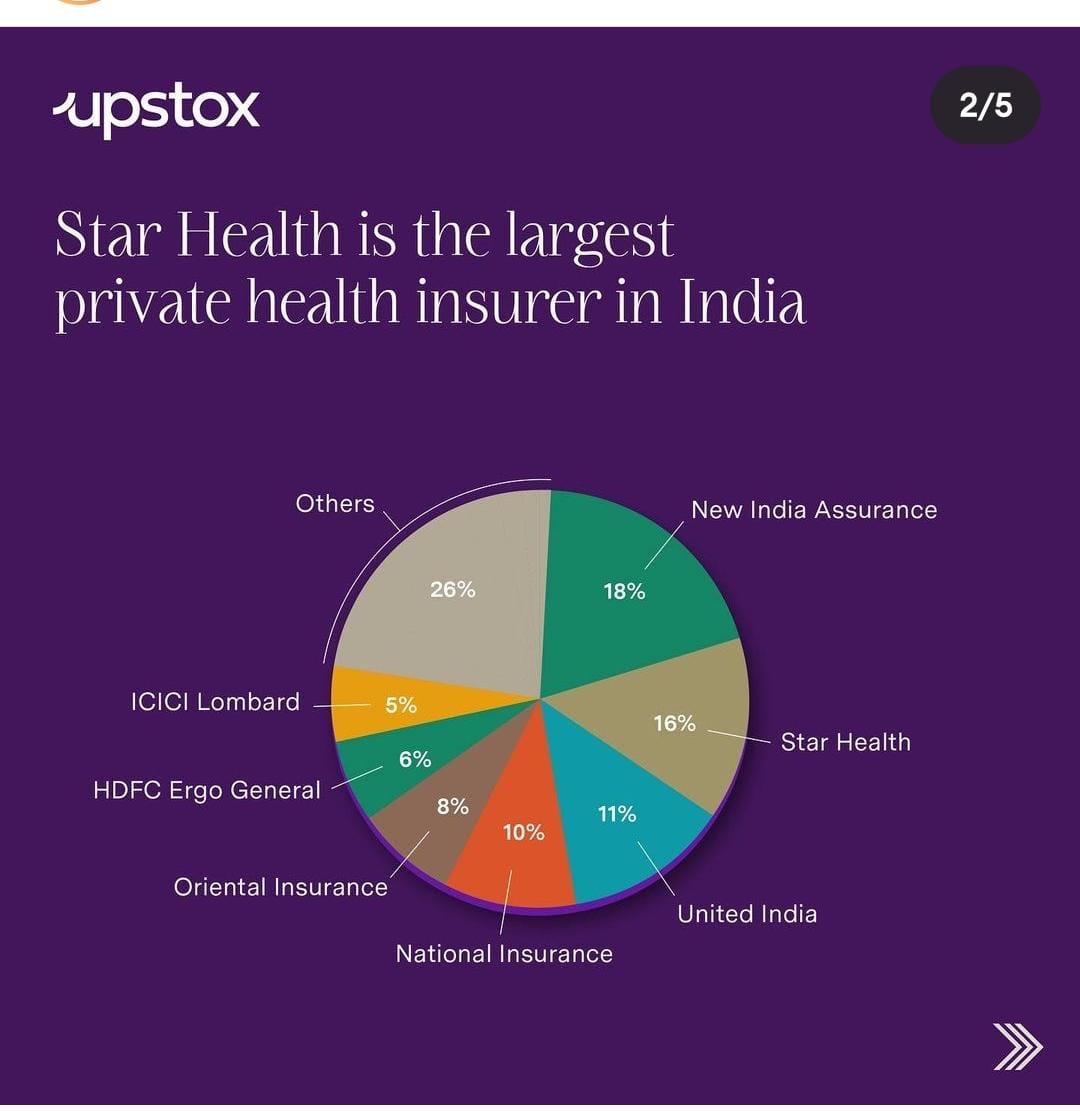

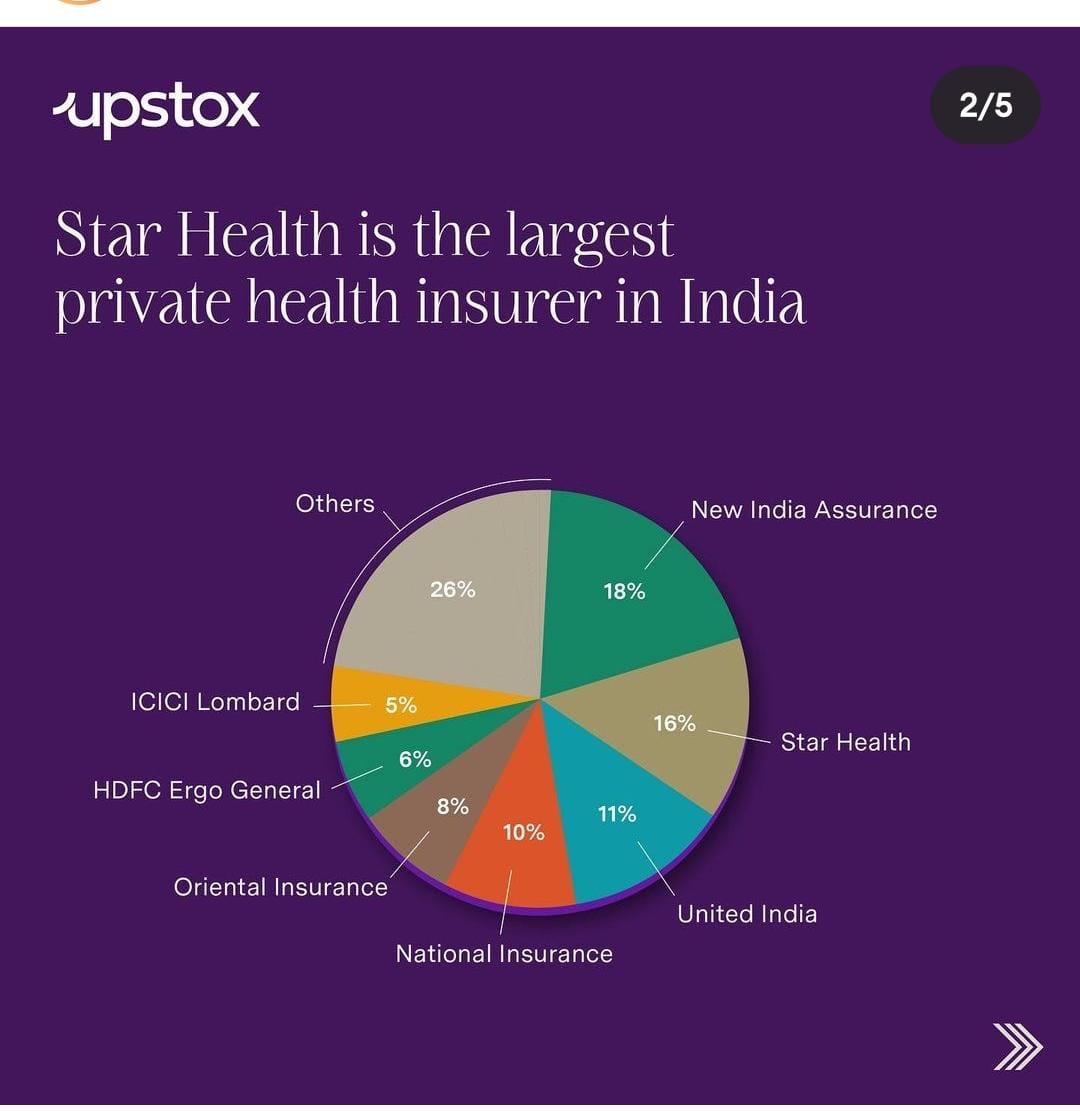

Star Health is a leading private health insurer in the country, is owned by a consortium of investors like Westbridge Capital and Rakesh Jhunjhunwala.

Star Health’s IPO comprises fresh issue of equity shares worth ₹2,000 crore and an offer for sale of up to 58,324,225 equity shares by promoters and existing shareholders. At the upper end of the price band, the public issue is expected to fetch ₹7,249 crore.

The Star Health IPO has got 75 per cent reserved for qualified institutional buyers (QIBs) and 15 per cent reserved for non-institutional investors (NIIs). The remaining 10 per cent of the issue is available for retail investors.

Commenting on the upcoming IPO, Ravi Singh, VP and Head of Research at Share India Securities said, “Due to the Covid pandemic, the awareness in health insurance sector has increased and the retail health market segment is expected to emerge as a key growth driver for the overall health insurance industry in India.”

He added that the Health Insurance sector has a strong positive outlook and since there are only two listed general insurance companies – ICICI Lombard and New India Insurance, he expects Star Health a good option to invest for long term.

The share allotment is likely to take place on December 7, 2021, and the shares are expected to be listed on December 10, 2021, according to the timeline given in the RHP.